The recent 90-day pause on US tariffs on Chinese imports has sparked a dramatic surge in demand, as American importers scramble to front-load shipments ahead of the 14 August deadline. The demand spike is now placing considerable pressure on supply chains across Asia and Europe, threatening to disrupt global freight flows into the traditional peak season.

Freight bookings from China to the US rocketed 300% in just one week, marking the highest volume levels of the year so far, as US importers use the temporary reprieve to push through previously delayed shipments.

While the tariff rate remains high at 30%, it is significantly lower than the 145% rates imposed earlier in the spring. Importers are moving quickly to take advantage of this limited window of cost certainty, but the consequences are already being felt far beyond China’s borders.

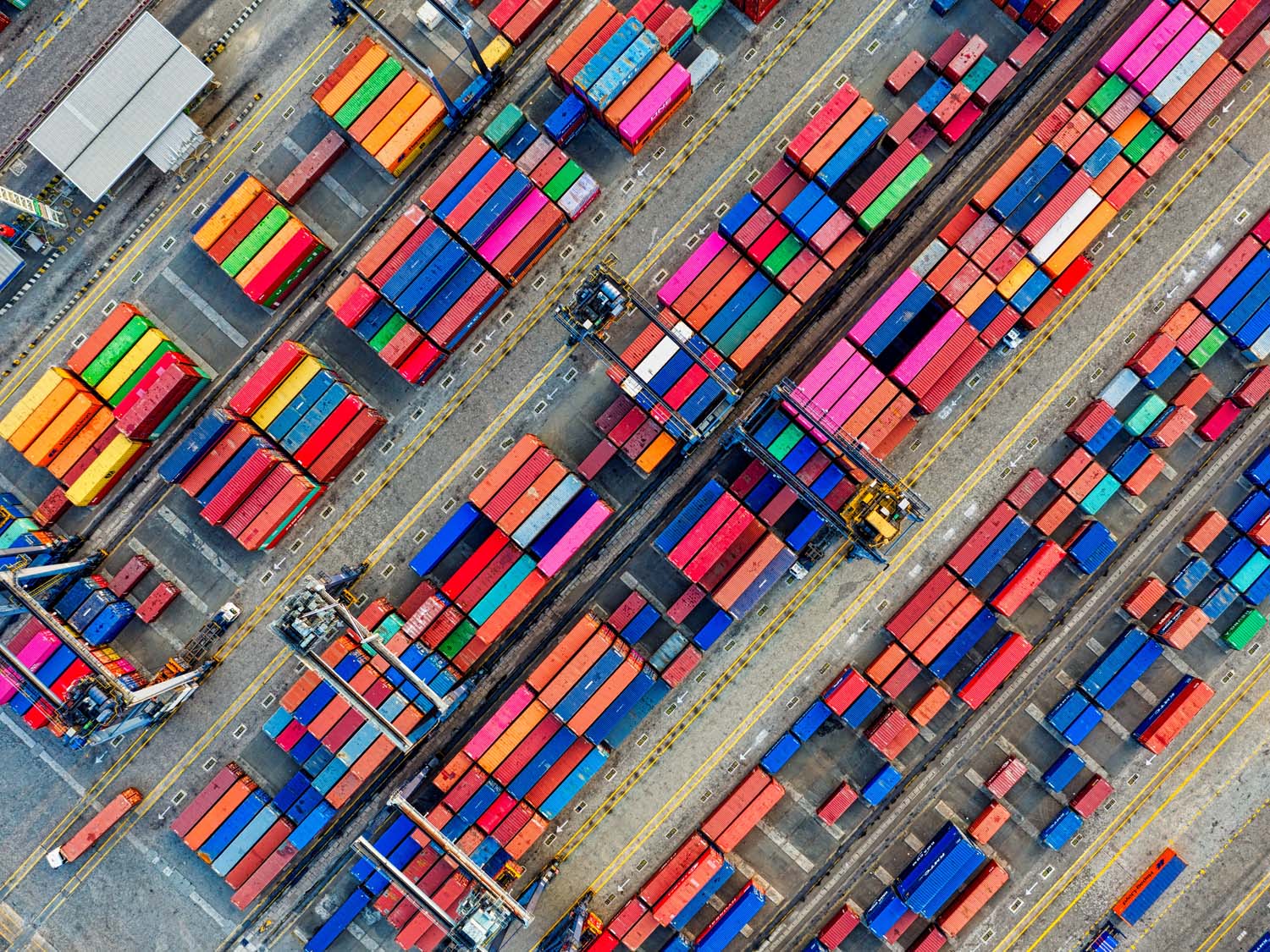

With ships now flooding back into Chinese ports, congestion has rapidly intensified:

- Shanghai and Qingdao are experiencing berth waiting times of 24–72 hours.

- Ningbo reports delays of 24–36 hours, while the congestion there is now worsening due to diverted volumes.

- Busan is reporting 72-hour waits at the PNIT Terminal.

- Singapore and Yokohama are also affected, with waiting times up to 36 and 24 hours, respectively.

Carriers are reporting widespread bunching and missed berths, forcing some vessels to skip port calls entirely. Simultaneously, container availability is tightening, especially in Shanghai and Ningbo, where carriers have begun rationing equipment based on rate levels and space commitments. Maersk and HMM are among those limiting container release in an attempt to balance capacity with available slots.

Further down the line, ports in southern China, Southeast Asia, and even intra-Asia trades are also reporting backlogs. Shenzhen, Hong Kong, Ho Chi Minh City, and Port Klang have all seen yard utilisation rise and service delays build.

Strain Spreads to Europe as Container Flows Disrupt

The congestion is not limited to Asia. As carriers reposition vessels and adjust service rotations to meet surging demand on eastbound transpacific routes, European ports are beginning to feel the knock-on effects.

In northern Europe:

- Hamburg is facing 5–6½ days of berth delays,

- Southampton and London Gateway are seeing 3-day waits,

- Antwerp is experiencing severe disruption with delays extending to 15½ days,

- Piraeus and Tangiers are also impacted, each facing waits of up to 4 and 3 days, respectively.

Labour shortages, reduced barge capacity on the Rhine, and tight schedules are compounding these delays. Meanwhile, rerouted vessels from Asia–Europe services are creating bunching at key transhipment hubs such as Bremerhaven and Hamburg, which in turn serve Scandinavia and the Baltic.

Equipment Shortages and Capacity Gaps Ahead of Peak Season

Container availability is expected to worsen in the coming weeks. With vessels already departing China at high utilisation levels, the return of empty containers and the repositioning of ships to Asia may not keep pace with demand.

If previously produced goods held in bonded warehouses are added to this surge in volumes during May, demand could increase by nearly 50%. A delay to June would ease the burden, but it could still be over 15%, which still represents a steep challenge ahead of the summer peak.

This front-loading of cargo to the US may lead to a sharp, compressed peak season starting now and stretching into mid-July, followed by potential equipment shortages and service volatility in August and beyond.

We are closely monitoring port performance, vessel schedules, and rate volatility across all major trade lanes, to support customers with:

- Priority bookings and space management on transpacific and key routes

- Equipment selection and container allocation strategies

- Alternative routing and scheduling options to avoid bottlenecks

- Global shipment visibility to SKU

EMAIL Managing Director Andrew Smith to discuss current conditions, risk mitigation, and booking options tailored to your business priorities.