Between the start of April and last week, average spot rates from the Far East into North Europe increased by 31%, the US West Coast 30%, Mediterranean 25% and US East Coast 22%, with spot rates to Europe currently $6,000-$7,500 and analysts suggesting they may hit $10,000.

Market demand reached record levels in Q1 2024, up by 9.2% compared to Q1 2023, and coming at a time when the Red Sea situation was already putting pressure on shipping capacity, rate increases were inevitable. But it is the speed at which market turmoil has developed, that is creating nervousness in the market, with spot rates to Europe rising 6% in the last week.

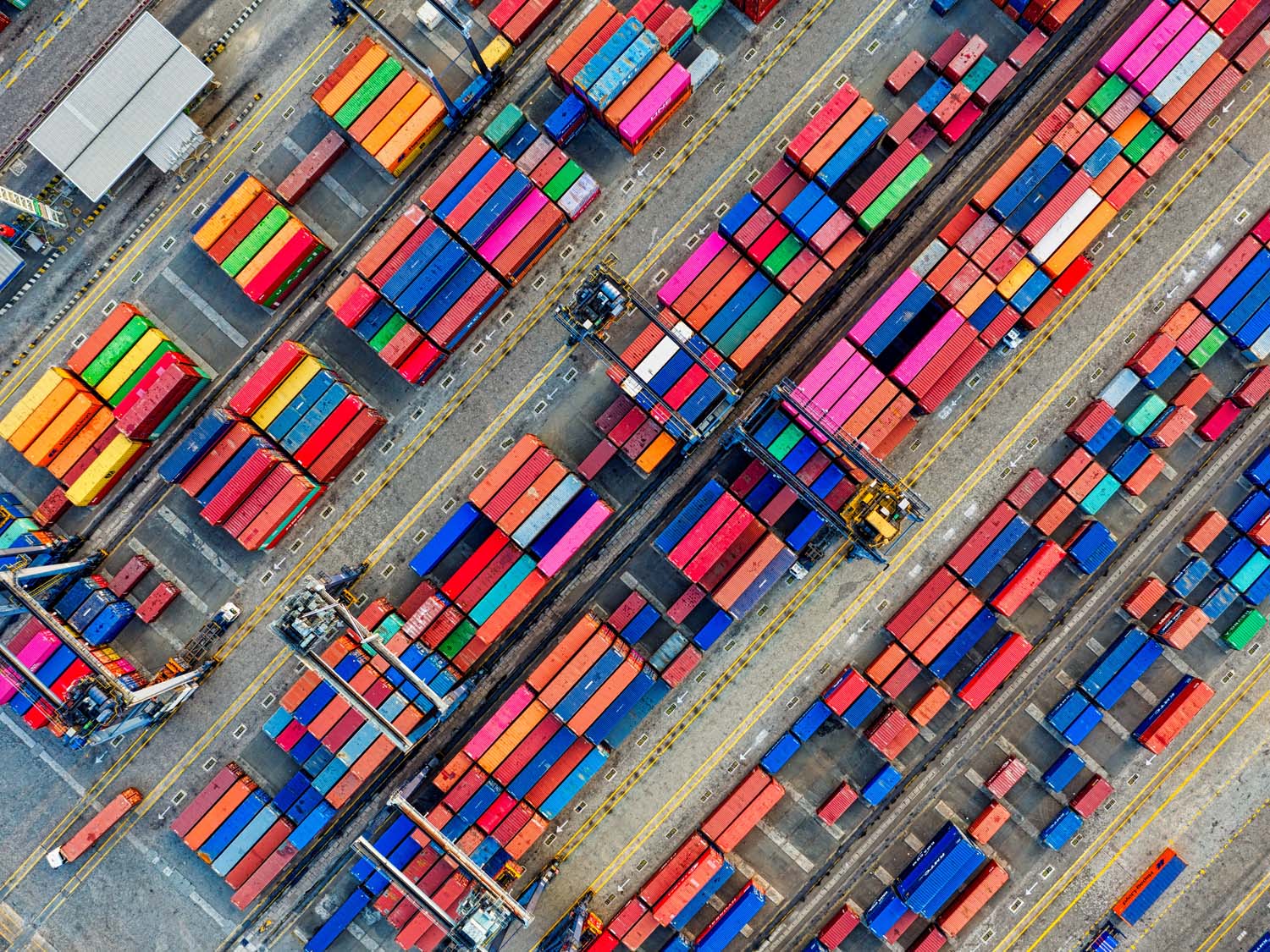

Schedule reliability is still far from pre-pandemic levels, with Q1 on-time performance mooted to be just 27% which, combined with pockets of congestion, port omissions, delays and missed departures is having a massive impact on equipment availability at export hubs.

COVID-19 supply chain disruption is fresh in the memory of shippers and fearing a squeeze on capacity during the peak season many are importing more goods now. The traditional peak period, like the weather, is changing its seasons.

Much of these increased volumes are moving on the spot market, which is putting upwards pressure on rates, particularly as rising port congestion and equipment shortages are further diminishing available capacity.

In addition, with the delays and the impact on shipping schedules, caused through both carrier voluntary or involuntary port blankings, contract capacity is being reduced or completely removed, against agreements made earlier in the year, or at the backend of 2023. Sound familiar?

Long term rates on major trades have remained relatively flat in Q2, but with reduced space availability they are not covering the forecast allocations forcing shippers to find alternatives for the shortfall in demand for box movements.

Short term spot and FAK rates are the only real mechanism as an alternative solution and this is currently absorbing all available container slots in the westbound Asia/ Europe trades.

Meanwhile, carriers will continue to make money from the spot market’s additional volumes ahead of the traditional peak season and that is what we have seen in the rate increases in May that look to continue, and possibly accelerate, as we enter June.

The shipping lines are not the cause of the current situation, but there are advantages to a commodity driven model, where demand exceeds supply from their perspective.

However, the large BCO shippers are too aware that the bigger the gap gets between the spot and contract markets, the greater the risk that more of their cargo may get rolled, in favour of higher-yielding containers. This creates further demand and a willingness to pay higher rates, to ensure that product is shipped and deadlines can be met.

Even if there is capacity in the market, the fear factor can push up rates and shippers could be facing months of further elevated rates and increased delays, if higher demand continues to overtake available capacity.

However, the duration and scale of these price spikes could be less severe than those seen during the pandemic because volumes are increasing and not surging, which should mean that ports will (in time) be able to handle the higher volumes and strategies developed during the pandemic, like off-port container yards, are already in place.

It is unlikely that this can be sustainable long term for any party or for the length of time seen during the Covid Pandemic days of lockdowns and increased consumer spending. There are other factors at play, in creating a similar environment to 2020/21 market conditions.

As we advised many weeks ago, the next large scale disruption which is beginning to really have a major effect is the lack of equipment where it is required in the manufacturing regions of Asia, due to shortages of available empty containers that are either ‘stuck’ on longer transiting vessels, or laying idle at destination (such as the Med) awaiting evacuation back to Asia.

The impact in China is becoming very acute with a lack of available empty boxes creating bottle necks throughout the main gateways and congestion and queueing times increasing daily for vessels.

In addition, if the demand increase has been driven by an early start to the peak season, then we may expect demand-side pressure to begin easing off in a few months, although volumes and rates are likely to remain elevated for a while longer, due to the turbulence that is a consequence of the market conditions that are currently at play throughout the globe.

We will continue to update on the evolving situation, which is gathering pace due to many factors and dynamics. We do not foresee any short term rectification of the current market conditions which will undoubtedly continue to pay havoc with supply chains.

We will always offer the best options available, being creative with the solutions that we offer – based on customer requirements – ensuring we always deliver against deadlines.

With carriers in the ‘driving seat’, they are cherry-picking which contracts to honour, rolling lower-yield containers and blanking vessels, to try and recover schedules.

With the market this challenging, there is no ’silver bullet’ and many shippers that try to play the spot market are coming unstuck.

Metro are leveraging our long-standing carrier relationships and sensible annual contracts, to guarantee our customers space and set rates.

To learn how we can enhance your ocean freight solutions, please EMAIL our Chief Commercial Officer, Andy Smith.