As planes descend into Monterrey airport, an expanse of warehouses and manufacturing complexes stretches out for miles, exemplifying the near-shoring boom that has swept through Mexico in recent years, as Asian companies and their supply chains move closer to the United States.

Drivers of Mexican Industrial Growth

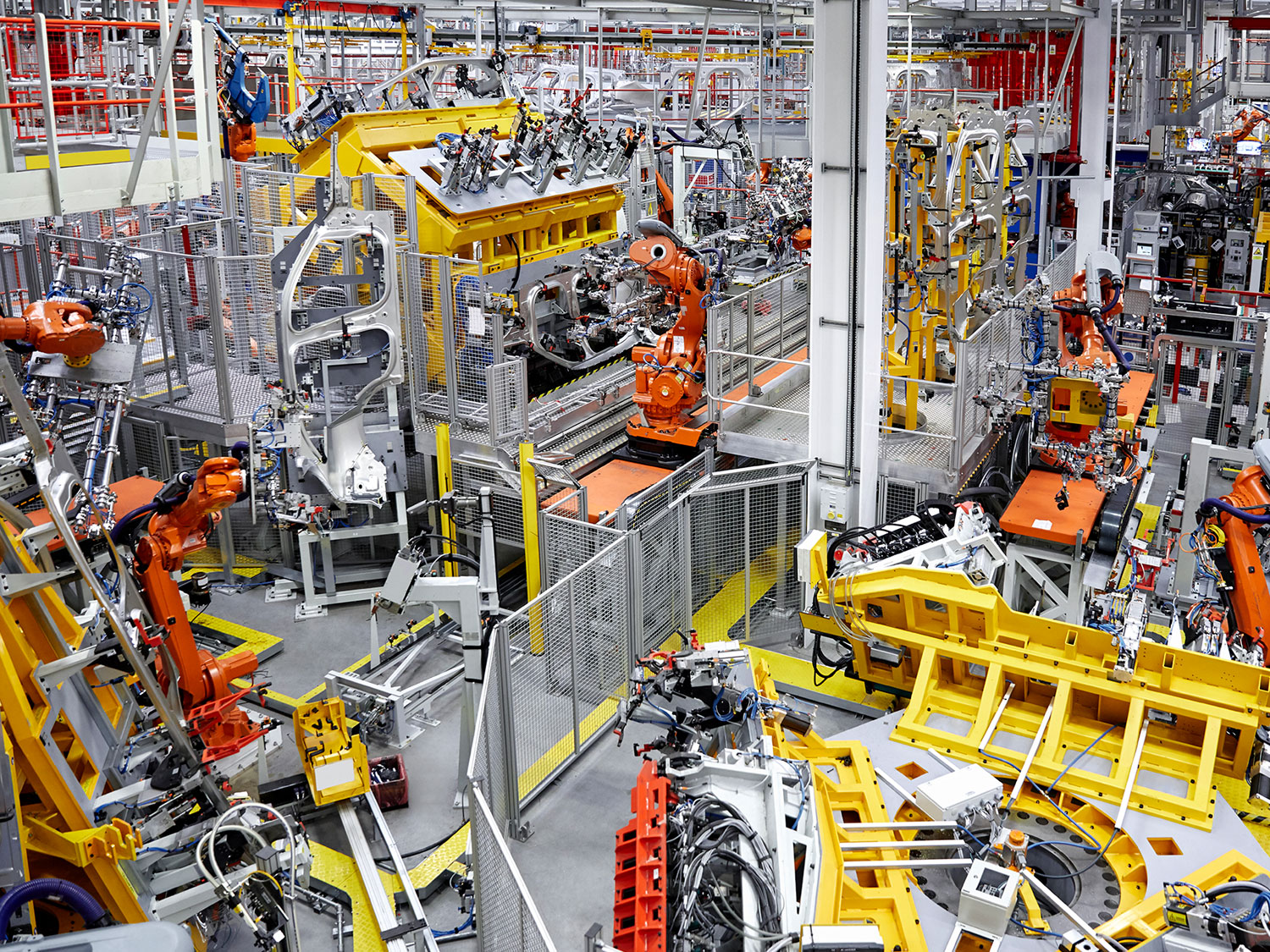

One might argue that this surge in Mexican industrial production and exports to the US is part of a 30-year evolution, initially driven by the North American Free Trade Agreement (NAFTA), which established a free trade area among Canada, the US, and Mexico.

However, additional factors have recently propelled Mexico to replace China as the US’s most important trading partner.

1. US-China Trade War: Trade has shifted from China to countries like Mexico due to the ongoing trade conflict

2. Biden Administration’s Supply Chain Strategy: Emphasis on near-shoring has highlighted Mexico’s role in the China+1 strategy

3. Production-Sharing Schemes: Mexico’s longstanding expertise in these schemes makes it a valuable partner in regional manufacturing and trade

4. Low Labor Costs: Average manufacturing wages in Mexico are lower than those in China

Ironically, many of the companies that are being set up for manufacturing and transition to Mexico are actually owned by Chinese entities and companies. It is a migration of Chinese manufacturing to Mexico and this also has the benefit of lowering supply chain and shipping costs and the big one – reducing some of the duty and anti-dumping duty that has been, and will likely continue to be, levied on Chinese origin goods and raw materials.

Lessons for Europe

A critical element is the presence of a long-standing free trade agreement, because near-shoring thrives in an environment that fosters supply chain relationships and networks over time and effective near-shoring relies on a regulatory and trading environment that supports such activities.

Expecting near-shoring to emerge without a developed and supportive environment is unrealistic. The EU, with its well-developed internal free trade and regulatory framework, together with external trade agreements with countries like Egypt and Morocco is well-positioned to adopt near-shoring strategies.

In Europe, geopolitical relations with China are a concern, but recent supply chain disruptions are increasingly driving the adoption of China+1 strategies. Europe has been shifting its manufacturing and supply chain activities eastward and into North Africa.

Opportunity

Countries like Turkey, Hungary, Egypt, Morocco, Poland, and Romania offer compelling near-shoring opportunities due to their lower wage rates and higher productivity compared to Western Europe.

The EU is well-positioned to capitalise on near-shoring activities and so too is the UK, with its close EU ties and inherited trade agreements. This has already been highlighted by the new UK government, as a goal to re-negotiate trade agreements with the EU and could make closer sourcing a more prevalent and cost effective strategy going forward in the next few years.

We are seeing regular migration of manufacturing and sourcing closer to the UK and EU and this has many benefits, as long as the material price is comparable with Far East manufacturing costs, which have been the big incentive.

Metro and our associate companies, are well positioned to give advice, recommendations and adapt supply chains regardless of the areas that you are sourcing from or selling to.

We have a variety of services and solutions covering overland trucking, rail freight, short-sea containerised solutions on our own vessels and local warehousing and distribution at most industrial hubs throughout Europe and North Africa.

Please arrange a call/meeting and we can go through the current and future options, to add value to your global development strategy. We can guarantee that it will not be time wasted!

Stable, well-regulated trading environments and cost-effective, high-productivity production locations in Central and Eastern Europe and North Africa provide a strong foundation for supporting near-shoring initiatives.

Metro’s integrated transport services are designed to support JIT manufacturing requirements across the EU, North Africa and Turkey and are ideally positioned to support new near-shoring requirements.

Our partner network, multi-modal transport solutions and MVT supply chain platforms are all geared towards supporting an evolving sourcing programme and on-boarding new suppliers.

If you would like to learn how we can boost your ability to source from alternative manufacturing regions, EMAIL our Chief Commercial Officer, Andrew Smith, to arrange a consultation and scoping discussion.