Nine consecutive months of record breaking imports from Asia together with global supply chain volatility and uncertainty, is congesting US terminals and choking the inland supply chain infrastructure.

Booming US imports from Asia accelerated even further in March, to 1.66 million TEU, up an astonishing 90.5% from the same period in 2020.

The top 13 US container ports recorded double-digit growth (in some cases triple) which explains why the busiest gateways have become the most congested container terminals, with long lists of waiting vessels idling at sea.

With many Asia factories remaining open over the Lunar New Year holidays ports didn't have the usual February/March lull to clear backlogs, which means that major gateways piled new imports on top of existing container backlogs.

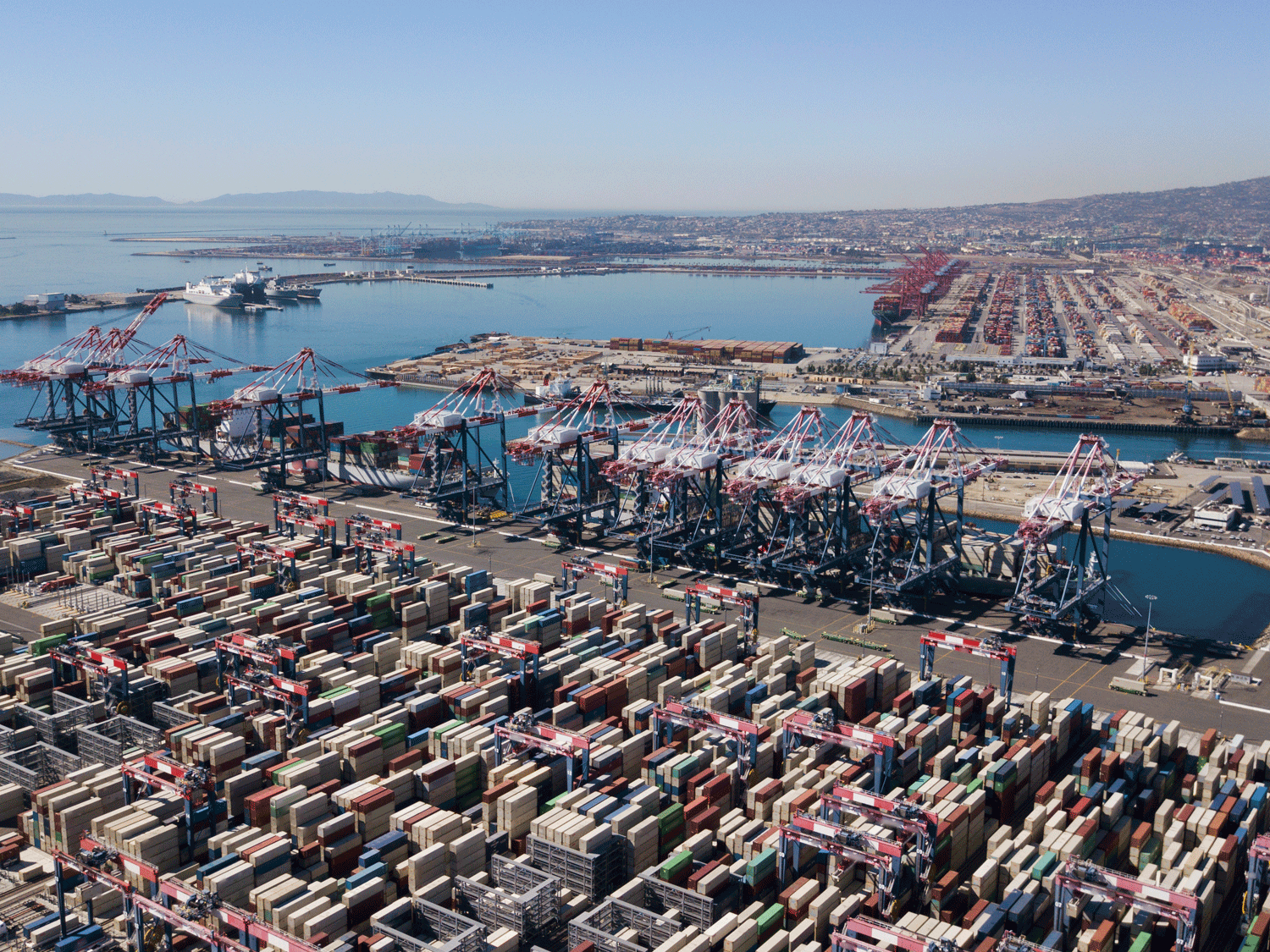

The impact was especially evident at Los Angeles and Long Beach, which process about 50% of US imports from Asia, with terminal congestion, vessel bunching, and chassis shortages.

To relieve pressure on the Southern California gateway shippers and carriers diverted volumes to other gateways such as Oakland, Seattle, New Jersey, and Savannah.

All of the major ports experienced some degree of operational issues.

Imports from Asia through Los Angeles-Long Beach in March were up 92.7% from 2020, while New York-New Jersey, the second-largest US gateway, experienced an increase of 114.1% year on year over the same period.

Imports from Asia in March also set records in Savannah (up 103.1% year over year), the NWSA (66.1%), and Oakland (up 73.5%), and showed strong growth in Houston (up 143.5%), Charleston (up 130.1%), and Norfolk (up 65.5%).

Current week update on US port operations

LOS ANGELES

- Vessel wait time is 8-12 days due to high import dwell and labor shortage

- Currently 24 vessels anchored

- Terminal Congestion is at critical levels with most terminals at or exceeding their capacity by 90% - 120%

- Rail car shortages causing berths to go idle

LONG BEACH

- Vessel wait time is 7-9 days due to high import dwell and labor shortage

- Currently 24 vessels anchored

- Terminal Congestion is at critical levels with most terminals at or exceeding their capacity by 90% - 120%. (same as LA)

- Rail car shortages causing berths to go idle (same as LA)

OAKLAND

- Vessel wait time is 8-12 days due to high import dwell and labor shortage

SEATTLE/ TACOMA

- Vessel wait time is 24 -36 hours due to high import volume. Yard capacity is at 100%

NEW YORK

- Vessel wait time is 24 -48 hours due to high import volume

SAVANNAH

- Vessel wait time is 5-6 days due to high import volume and tight trucking capacity

HOUSTON

- Vessel wait time is 24 -48 hours due to high import volume. Trucking and chassis availability is showing slow improvement

It is regrettable, but disruptions are to be expected during this time and we are doing everything we can to ease the impact, offer support, and provide alternative solutions where and if necessary.

We will continue to monitor and report on any disruptions, working through any challenges we may face, in conjunction with our dedicated teams and colleagues in America.

If you have any questions, concerns, or would like any further information regarding the situation in the United States, please don’t hesitate to contact Kevin Lake, who leads our North American operations.