Negotiations for a new labour contract with the International Longshore and Warehouse Union (ILWU), are due to start on the 12th of May and shippers are already sourcing products from Asia earlier than normal and directing more cargo to US East Coast and Gulf terminals, to avoid potential port chaos on the US West Coast.

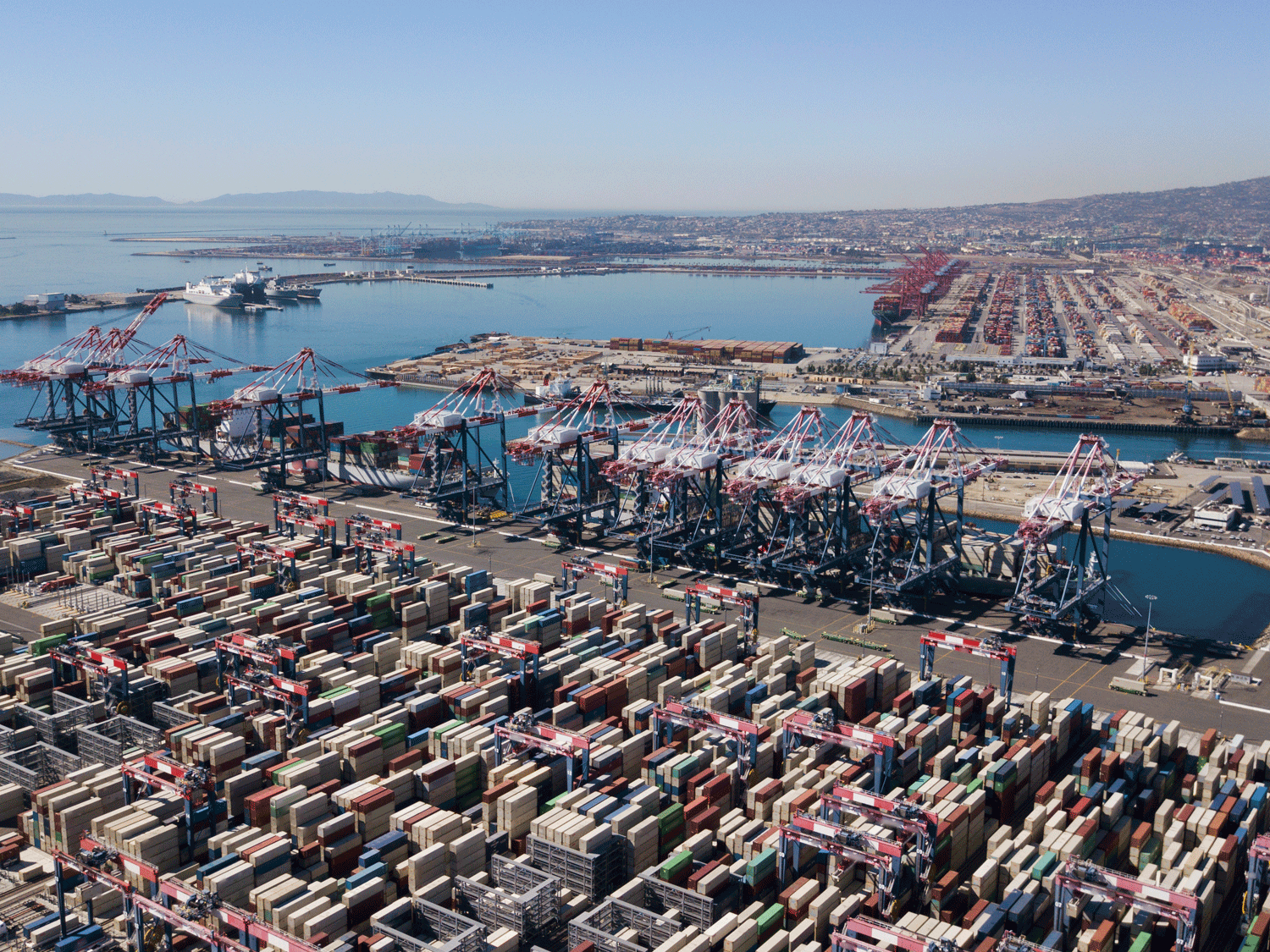

Contract negotiations between the ILWU (which represents nearly 14,000 port workers in California, Oregon and Washington State) and Pacific Maritime Association (PMA), on behalf of shipping lines and terminal operators at 29 west coast ports, will begin on the 12th of May, against a backdrop of vessel backlogs, congested marine terminals, and inland supply chains struggling to handle near-record cargo volumes.

The pending negotiations come amid fears from shippers that an impasse could result in further disruption, leading some importers to shift traffic to the East and Gulf coasts, in an attempt to avoid any potential problems.

There is some cautious optimism for the negotiations, based on the cooperation that was demonstrated by longshore workers and employers, in handling the import surge that is now in its 20th month amid the COVID-19 pandemic.

US Secretary of Labor Marty Walsh cautioned not to judge this year’s talks on how prior negotiations played out. “You can’t look at history of past practices to say, ‘Well, in 2014 it was pretty bad, so that means in 2022 it will be pretty bad. ’That’s not how negotiations work.”

Neither the ILWU nor the PMA has spoken publicly as to what issues they view as crucial in this year’s negotiations. However, the union in recent years has publicly opposed the spread of automation on the West Coast.

Employers, on the other hand, have noted that in order to continue handling record cargo volumes each year on waterfront property that cannot be expanded, some West Coast terminals will have no choice but to automate, as automation allows terminals to almost double the cargo volumes they can handle on the same footprint compared with operating manually.

In past negotiations, discussions involving wages normally were not a major sticking point. According to the PMA’s 2021 annual report, the average salary for full-time general longshore workers was $182,789. Marine clerks’ average salary was $203,533, while the average for foremen was $280,352. Quite incredible by anyone’s imagination.

The perceived risk of disruption has led many importers to re-evaluate their use of West Coast ports and many of those, that have not ordered early, to land goods ahead of June, are diverting cargo to East Coast ports.

The ports of New York and New Jersey, Virginia, Charleston, and Savannah have been experiencing congestion for the past year and the diversion of West Coast cargo is escalating vessel backlogs along the East Coast and deteriorating service for importers, with Charleston experiencing the worst of it. Currently, there are 27 vessels awaiting berth. Typically, berthing takes approximately 1 day. At this time, the average is 10 days.

There are alternative access ports you can consider diverting to, in Canada, the Gulf and the East coasts, but, with so much cargo already diverted from Los Angeles and Long Beach, there are questions about how much additional capacity the most popular ports actually have.

We would ask that customers shipping to, or importing through, the West Coast speak to us at the earliest opportunity so that we can review their situation and prepare contingency plans to protect them.

Kevin Lake and Andy Smith, who has spent the last week in The USA, are available to discuss the latest solutions both in shipping port to port and the inland first/final movement of containers. They have this week set up emergency platforms for customers to ensure that product is delivered to market in The USA, without the delays experienced through alternative providers.

With planning, visibility and a collaborative approach, we will continue to provide the best option available to ensure that your products are moved and expectations are met, or adjusted accordingly in line with the real market situation.