Date:

Supply chains face Omicron challenge both in UK and globally…

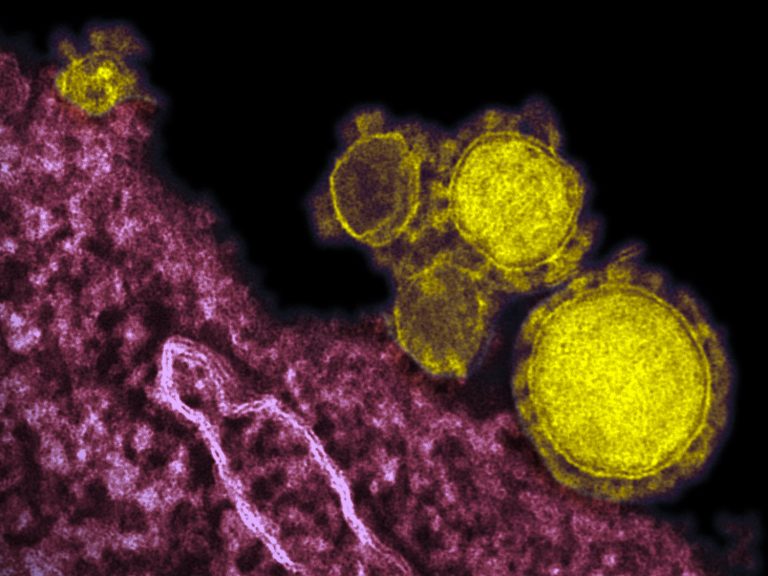

The Omicron variant is likely to be another test of supply chain resilience and could pose a threat to global economic recovery, particularly if China enforces its ‘zero-COVID’ policy, to prevent cases entering.

Yesterday evening’s announcement by the prime minister, Boris Johnson, of a new work from home directive and further actions to try and stymie any escalation in the new more transmissible variant, will impact supply chains, and it is likely that further global escalations will follow in many regions and territories.

Shippers, businesses and consumers have been affected by global supply chain disruptions for close on two years and the new Omicron Covid variant is likely to unleash new challenges on already-stressed supply chains. It’s not going away, as many had hoped or expected.

While there have been no reported cases of Omicron in mainland China and the country’s top respiratory expert stating: “We don’t need to be afraid of Omicron”, China’s ‘zero-COVID’ policy has in the past included mass lockdowns, enforced quarantines and strict checks at ports. Which have significant knock-on effects both up and downstream in supply chains, as demonstrated by the shutdowns in Yantian and Ningbo earlier in 2021.

If this does happen, logistics operations and shipping by all modes will be constrained, shortages of manufacturing components will likely grow and extended order backlogs for core electronic, automotive and consumer products are inevitable, as a consequence.

The pandemic triggered the shift in spending from services to goods, which has been one of the key drivers of the demand boom causing bottlenecks in the supply chain. If Omicron leads to a new wave of the pandemic, it is likely that consumer demand will remain on goods, maintaining intense pressure on global supply chains.

Across the G20, the OECD raised its inflation forecast for 2022 from 3.9% in its September predictions to 4.4% now, with inflation in the UK forecast to rise by 4.4% next year. Which seems a very tame notion considering all the cost increases to commodities, energy, logistics, salaries and at every point within the supply chain, that are being felt globally.

Laurence Boone, chief economist of the OECD, told the FT that the Omicron variant was “adding to the already high level of uncertainty and that could be a threat to the recovery, delaying a return to normality or something even worse”.

International air travel capacity and demand has been increasing on the back of rising vaccination rates and deceasing air travel restrictions, but this upswing may be short-lived, if international travel bans are imposed by countries responding to Omicron.

(Which they already are in the last week and the risk is travel sentiment may subsequently decline back to the levels seen earlier this year.)

Airlines in countries with large, strong domestic markets like the United States, China and Russia are better shielded from the greater uncertainties of international travel and U.S. carriers have not yet changed their scheduled capacity, which is running at 87% of 2019 levels.

Major European airlines are far more dependent on international travel, especially on the more profitable long haul routes outside of Europe, placing them more at risk of fallout from the Omicron variant. Including a restriction in the belly hold capacity of aircraft that are predominantly passenger reliant for their revenue streams, further impacting air cargo options on uplift.

In The Asia Pacific region, countries like Australia, Japan, Singapore and Thailand had only begun to cautiously lift border restrictions in recent weeks and passenger numbers remained at fractions of pre-pandemic levels before the Omicron variant was discovered.

Renewed restrictions and flight cancellations could have ramifications for air freight, with cargo capacity potentially decreasing by 30%, particularly on the key trade lanes between South Africa and North America, Europe and Asia. Due to strong demand, spot rates are also likely to increase, until the end of the year, in the extended peak shipping season.

Omicron is just one of thousands of mutations already discovered and the likelihood is that we will see the emergence of more variants going forward, with their impact dependent on the political and behavioural response of consumers.

Outside China, regional governments are likely to resist re-imposing severe restrictions, but the bottom line is that supply chains will remain under pressure while the Omicron and COVID threat persists. This will impact internal regional logistics, global shipping and supply chains we suspect in the coming weeks and months.

We will always ensure that we have the latest information and make the correct decisions to ensure that products and cargo continue to flow whatever the circumstances. In an agile way in a changing situation.

The supply chain impact of Omicron and further future variants can be profound, which is why we monitor the emerging situation locally, through our operations teams and globally, with our network partners.

We remain hopeful that resulting issues will be limited, although we suspect that any impact will differ significantly, by region and we are likely to feel any effects for weeks to come.

As we receive further news, updates and developments, we will share anything of relevance, to keep you advised of the situation. Covering ocean, air and overland movement of your goods, during a challenging time.

For further information please contact your Metro account manager or Grant Liddell, if you require escalation for any urgent shipments, or simply want to discuss the daily evolution and development of events impacting global logistics. It’s what we do…..