Date:

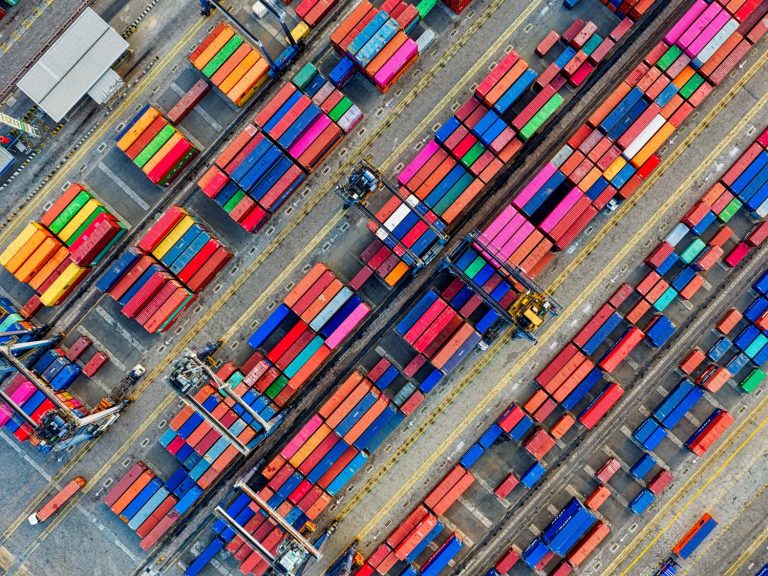

Schedule reliability and port congestion in decline

The latest, market leading source, Sea-Intelligence schedule reliability figures show a slight decline of 0.7% in September to 45.5%, which is the first fall since reliability began to trend upwards in April and follows the year’s largest reliability increase of 5.8% in August.

The average delay for late vessel arrivals has been dropping consistently since the start of the year and In September improved once again, albeit slightly, dropping by -0.10 days, bringing the average delay to 5.81 days and is the second consecutive month that the delay has dropped below the 6-day mark since April 2021. Pre-Covid pandemic situation this would have been deemed completely unacceptable. But transits and measurements have changed over the last few years and many traders would like to slow down their products in transit in the current global environment so it is actually, by some businesses adjusting their supply chains in line with current consumer demand, considered a benefit we have observed.

With schedule reliability of 53.2%, 2M was the most reliable carrier in September 2022, followed by CMA CGM with 45.5%, with another four carriers recording schedule reliability of 40%-50% and the remainder at 30%-40%, or lower, it has been widely reported in the trade news.

Yang Ming recorded the lowest schedule reliability of 35.1%. In September 2022, once again, most of the carriers were very close to each other, with the difference between Yang Ming at the bottom and CMA CGM at second, a little over 10 percentage points.

Despite schedule reliability improvements global port congestion remains an issue with ~11% / 2.8m TEU of capacity tied up due to bottlenecks, labour shortages, industrial disputes and other post-pandemic disruptions.

The overall trend is on a downward trajectory, as congestion is starting to ease across the main hotspots in the US and Europe, though there was a small increase in vessels waiting at Chinese ports, due to weather related issues and isolated COVID lockdowns.

US East Coast port congestion is improving, with Savannah remaining the most congested port with 33 vessels recently waiting at anchor. US West Coast congestion is now almost cleared with only a handful of vessels waiting in the San Pedro Bay area.

The situation at the main European ports remained largely unchanged, although dockworkers at the Port of Liverpool began their second strike last Monday and are set to continue through this week, and with no agreement reached with the Unite union at Felixstowe, there is a risk of further industrial action at either port before Christmas.

We are working closely with our offices and network partners to monitor the situation throughout US and European ports, with contingency plans to ensure product is delivered to market, without delay, until congestion finally subsides.

To learn how we can help you avoid disruption and port congestion, or to request our regular ocean market report, please EMAIL our sea freight director, Andy Smith, who can advise on the best solutions for your ocean supply chain.

The freight market is changing every week, across all modes – we have the latest intel and will share our recommendations on the coming months and into the New Year of 2023 – a NEW challenge approaches. You are in safe hands to ensure you have the options available to achieve your future plans. Across the board we try to future proof all aspects of global trade to ensure that you achieve, as an agile leader and ambitious partner to your business.