Driven by demand surges and equipment shortages contributing to capacity constraints, container freight rates are rising to 2020 highs as carriers on the eastbound trans-Pacific implement the fourth GRI since the 1st June.

Anticipating a continuation of weak demand, carriers blanked 63 sailings from Asia to North America from the beginning of June through to the end of July 30 to manage capacity, but US imports began to surge in late June, as some states began to reopen following their COVID-19 lockdowns.

Reacting to the demand surge, carriers implemented GRIs on 1st June, 15th June and 1st July, driving rates up 98% and 25%, compared to a year ago, to the west and east coasts respectively.

Demand for personal protective equipment (PPE), products for at-home offices and back-to-school remote learning are driving much of the spike in freight pricing.

Equipment shortages in Asian ports, as well as in US gateways, are also driving spot rates higher.

Analysts suggest that we are seeing a second wave of PPE, representing 10-15% of all inbound cargo. PPE shipments originally surged in April and May, backed off a bit in June, and then began its second spike in July.

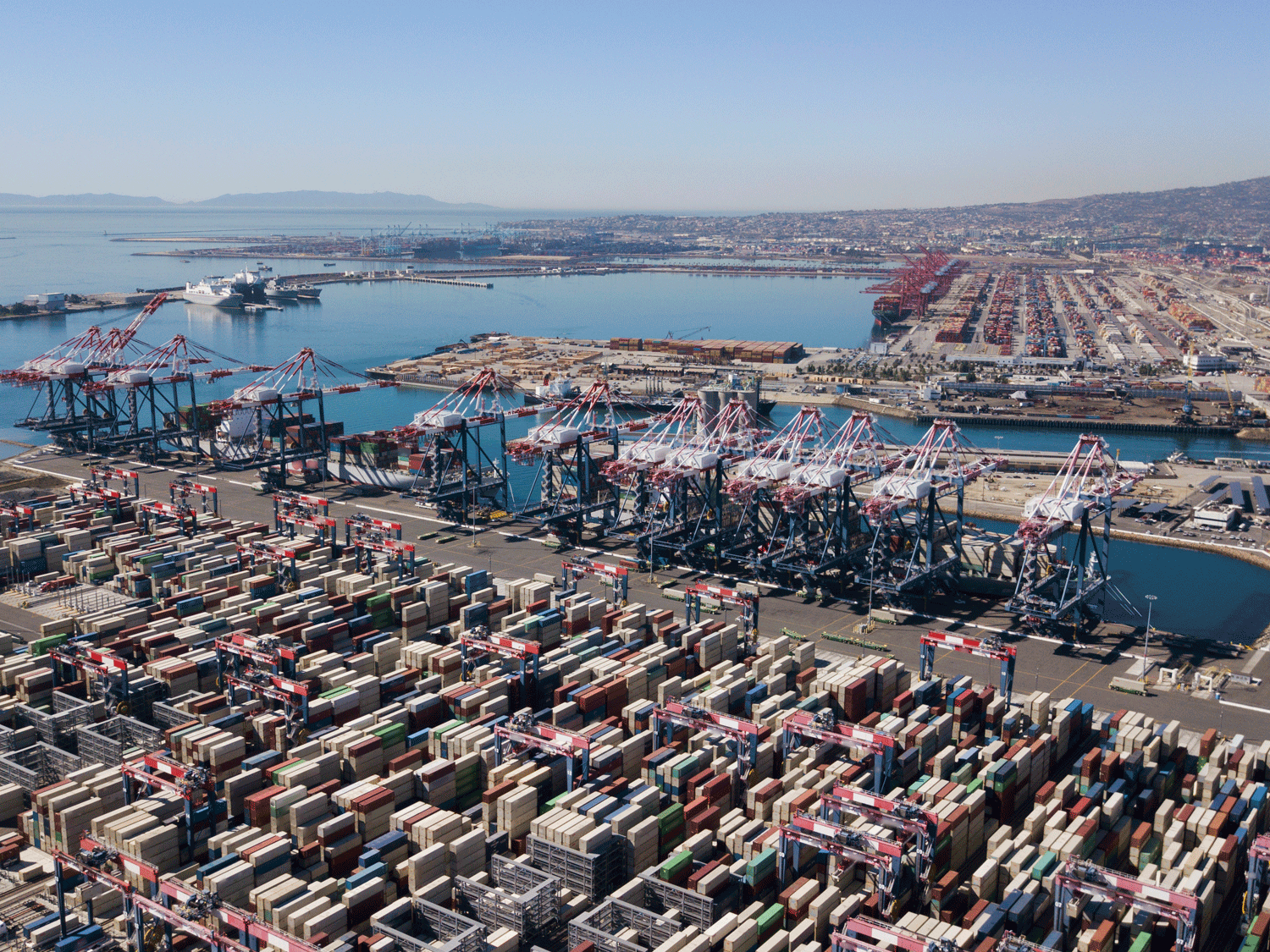

The ports of Los Angeles and Long Beach continue to handle the bulk of the import surge as time-to-market is crucial for just-in-time shipments destined for large consuming populations in the US interior.

Transit times from Asia to West Coast ports are about 10 to 14 days faster than to East Coast ports.

Although spot rates to the East Coast are climbing, the differential with the West Coast, which is normally close to $1,000 per FEU, is now only about $500, which indicates import volumes are strongest to the West Coast.

Equipment shortages are contributing to capacity constraints, with exporters in Shanghai, Taiwan, and Vietnam having trouble securing 40’ and 40’ high-cube containers.

In the US gateways, it’s a chassis shortage or dislocation problem, mostly in Los Angeles and Long Beach.

Carriers have announced only three more blank sailings to the West Coast and three to the East Coast in August and September, which should relieve some of the vessel capacity issues in Asia.

The United States is the UK’s biggest trade parter after the EU. Metro move large volumes of cargo to and from the US, with regular sea and air services, from the UK, Asia and other key cross-trade locations.

Metro has competitive agreements with all the major alliances, across all primary ports and airports, to give our customers reliability and choice, which is especially important in the current environment of blank sailings.

Despite the claims of equipment shortages in Asia, we have not experienced any issues in positioning the equipment of our choice. We continue to monitor the situation across all trades and will report any significant developments.

In addition, our excellent customer service teams and digital platform MVT ensure that our shippers and their stakeholders have real-time visibility and access to an array of online tools to closely manage their supply chains during times of service uncertainty.